PropertybyBuBen Case Studies

Strategy:

We have now been analysing properties in Ipswich for over 2 years and our current purchase strategy targets:

Houses centrally located in Ipswich with at least 3 bedrooms.

Price point: £180,000 – £250,000.

Possibility to re-configure and add 1 or 2 additional Bedrooms.

Potential to convert the property into a House of Multiple Occupation (HMO), either immediately or mid-term.

It MUST be Net Cashflow positive when rented as a standard Single Let property.

Recently completed purchase:

Address: 60 Grove Lane, Ipswich, IP4 1NY

Purchase Specifics :

Secured for £210,000

- Projected value at the time of agreeing the price based on local comparisons: £220,000 – £230,000

Centrally located, with convenient access to the Town Centre, Ipswich Hospital and Suffolk University.

We invested £4,032 in initial refurbishment work and we project this has increased the value of the property by £10,000-20,000.

The House will initially be rented as a Single Let and we project a monthly Net Cashflow of £376, which includes a 10% contingency for maintenance & voids.

Tenants were found and secured within 7 days.

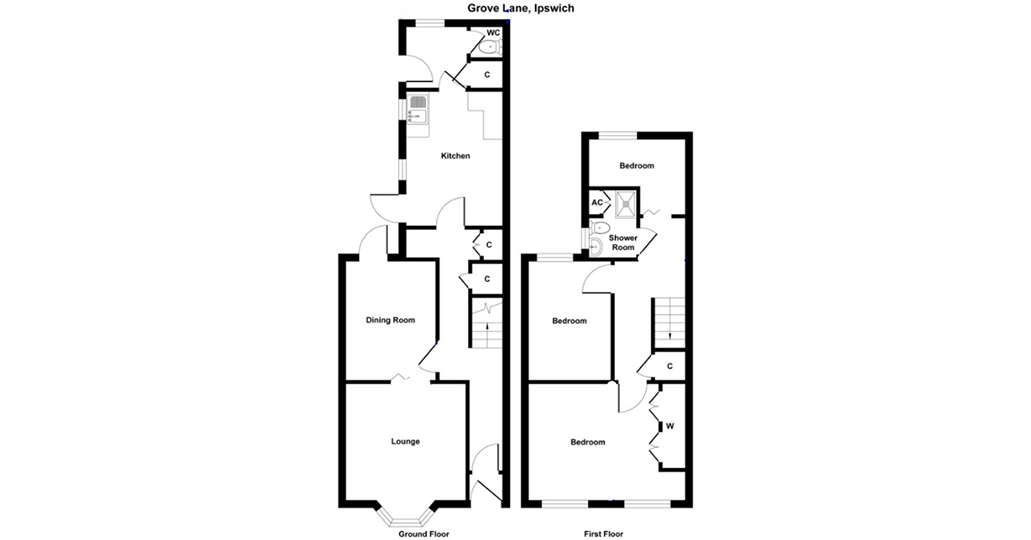

Excellent potential for HMO conversion:

- 2 large reception rooms downstairs, which can be converted into Bedrooms

- A 2 Bedroom loft conversion can be added into the roof, as other properties on the road have already done.

Given the purchase price, refurbishment works and general growth in the Ipswich property market, we would be confident to sell this property for £250,000, if we were selling.

*Please scroll down for the full cashflow calculations for 60 Grove Lane.

Before & After Photo’s:

60 Grove Lane – Single Let Monthly Cashflow calculations:

*UK Government Stamp duty hasn’t been included as it varies depending on each Investor’s personal circumstances.

We recommend you consult a specialist Property Accountant to provide professional guidance on all Tax matters.

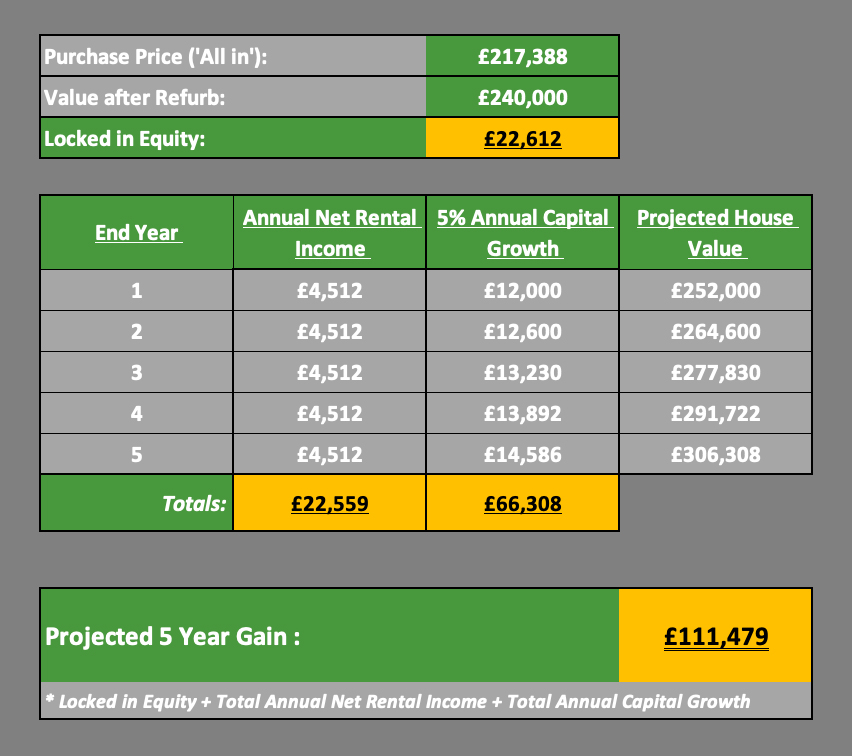

60 Grove Lane – Cautious Projected 5 Year Total Gains:

How has caution been factored in?

Value of Grove Lane is likely £250,000, reducing locked in equity values and base level from which growth projections are made.

Single Let Rent has a 10% buffer to cover maintenance & voids.

Rental projections are all based on 2021 values, in reality prices will increase gradually.

Ipswich housing market is currently growing at 8% or higher.

No consideration has been made for if the property is converted into a House of Multiple occupation (HMO) at any point, which would increase both rent and property value, noting that additional investment would be required

Deal Sourcing

Utilising local knowledge, network and experience we find property deals and pass them on to our Investor Network. A ‘Finder’s Fee’ is charged for our time & service, typically £5,000 + VAT

Property Investment:

Are you considering Investing in the UK Property Market but have limited time to gain confidence and take that step? Or are you lacking time to research and add to your portfolio?

Our core service is sourcing property deals for investors to purchase; we negotiate the deal, secure the property and introduce you to the Vendor to complete the purchase.

We call upon our local knowledge, network and experience to find property deals, passing them on to our Investor network. Typically, we target properties in the in the region of £180,000 – £250,000 in Ipswich and £450,000 – £550,000 in Cambridge.

Ownership & Expertise:

You, the Investor, own the Property in your name, we are purely the deal hunters and negotiators, saving you time and money, whilst securing you a profitable long-term investment.

Would it help to know PropertybyBuBen is continually focused on identifying deals within our target area, handpicking Opportunities for our Investors?

Our commitment is to only offer deals to our investment network, which we would buy ourselves, naturally you may ask ‘why then don’t we buy them ourselves’? Well, quite simply there are a lot of quality investment opportunities and we don’t have unlimited cash reserves.

Service & Charges:

We offer a personalised service to our Investors, where we discuss and understand your goals to enable us to find a property specific to your requirements.

In addition, with your permission, we will add you to our ‘Deal of the Month’ mailing list.

A ‘Finder’s Fee’ is charged for our time & service, typically £5,000 + VAT. We believe this is fair due to the quality of deal we have found for you, an investment we are confident will be profitable both in the short and long term.